The Permian Basin In a New Corporation: Part 2

How a bankrupt railroad became the purest oil play in America.

Before (or after) reading if you found this article interesting or fun to read please do not hesitate in subscribing and sharing!

In part 1, which can be found here: The Permian Basin In a New Corporation: Part 1 I focused on recapping much of how the Texas and Pacific Land Trust came into existence and eventually transitioned itself to a more modern management structure, a Delaware Corporation. In Part 2, I plan on providing a valuation of TPL’s assets (land, royalties and water business) as well as elaborate on a bear, bull and super bull case for investment in TPL.

Value of Land Assets

As clearly stated on TPL’s website they have approximately 880,000 acres of land spread across west Texas primarily centered on the Delaware basin within the larger Permian Basin. Of the 880,000 acres or so 23,700 are active and producing royalties. A couple challenges arrive from the beginning.

Land with active royalties ought to be worth more than land that has none…

The value of the royalties themselves (since they are held separate from the land) which will be covered in the next section.

For the land to have value, there must be a market for it. TPL’s land is focused in Hudspeth County, Culberson County, Reeves County and Loving County Texas; four counties right on top of the Delaware basin. They have land in 16 to 20 different counties (it is hard to tell on the map) with the highest densities of land and royalty acreage in the counties listed above. Below is what was found when trying to find the land value:

Raw Land: $600 - $1,200

Royalty Acreage : Not enough available data

Raw Land: $600

Royalty Acreage: Not enough available data

Raw Land: $1,000 per acre

Royalty Acreage: $25,000 per acre

Raw Land: $2,000

Royalty Acreage: Not enough available data

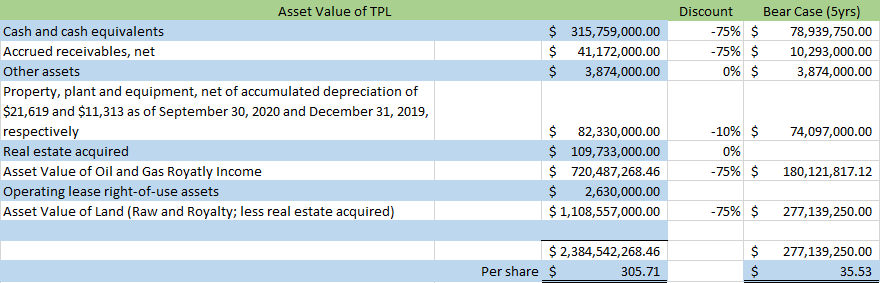

Unfortunately there is not plentiful data available to help value the land. Nonetheless, I will use $800 per non royalty acreage (Surface Acreage) and $25,000 per acre that has oil production taking place on it giving TPL royalty income. The $25,000 per acreage with a royalty interest is further supported buy recent purchases made by TPL and confirmed above by the current listing in Reeve’s county. See below right from the 10Q on page 6 (source):

“For the three months ended March 31, 2020, the Trust acquired approximately 756 acres (Culberson and Reeves Counties) of land in Texas for an aggregate purchase price of approximately $3.9 million, an average of approximately $5,134 per acre. For the three months ended March 31, 2020, the Trust acquired oil and gas royalty interests in approximately 1,017 net royalty acres (normalized to 1/8th) for an aggregate purchase price of $16.9 million, an average price of approximately $16,659 per net royalty acre.”

I applied a 10% discount to the $25,000 per acre of royalty acreage to play on the safe side. The discounted value of $22,500 accounts for both the land value and value of the royalty. Here is the math:

I subtracted the 23,700 Royalty Acreage amount from the total 880,000 surface acreage as to not count them twice. Worth noting is that the land and the royalty interest are held separately from each other making it possible for TPL to buy or sell just the land or just the royalty interest. Also, take the land values with a grain of salt (I would appreciate insight on valuing rural American land that is seemingly increasing in value). The $1,218,290,000 is equivalent to $156 per share or 18% of TPL’s total market cap.

Value of Royalty Assets

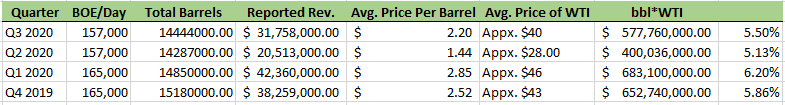

TPL has mainly 1/16th (6.25%) NPRI and 1/128th (0.78%) NPRI along with some other royalty rates that average about 1.4%. Looking at the past 4 10Q’s that were filled, a different story is told. When taking into consideration average oil prices for WTI Crude for each quarter and the BOE reported it looks closer to a 1/16th royalty rate than a 1/128th. (Keep in mind, I could not find any BOE data for the Oct-Dec 2019 period and relied upon the previous quarters data as this was pre-COVID and oil prices were strong then along with volumes.)

In regards to the 10Q (source) filed on 11/5/2020 for the quarter ending September 31, 2020 there was 157,000 BOE (crude, condensate, ngl) per day coming from TPL’s royalty acreage. TPL reportedly brought in $31,758,000 of revenue from oil and gas royalties making the average barrel of oil that TPL “retained” at $2.20. This is obviously lower than the average price of WTI in the same time period (Appx $40) as it should be. For this time frame TPL “kept” 5.50% of the oil that came out of the ground. I distilled the rest of the data below for the three previous quarters:

When considering the average price of oil for the last four quarters we have available data on, TPL consistently keeps 5-6% of the oil that comes from the ground. Some payments that are connected to oil extracted, for example, in Q1 of 2020, were not received and reported until Q2 of 2020. This may provide a buoy to TPL when current quarters are bad but will act as an anchor when current quarters are more lucrative than previous. It is a moot point but it could help smooth out TPL’s revenue streams.

When valuing the royalty income I am treating it as its own asset separate from the land. Essentially I am trying to value the oil itself because oil comes out of the ground every day of every quarter. Without trying to estimate the oil reserves of the Delaware basin and approximately how much oil is under TPL’s land, I will take 5.5% of every barrel of oil from TPL’s land multiplied by the average oil price for the last four quarters to obtain the asset value of the oil for this year. For 2020 this will be approximately 58,761,000 barrels of oil times 5.5% which equals 3,231,855 of retained oil for TPL sold at an average price of $39.25 or $126,850,308.75. There is many variables at play here. The more oil, the higher the price and the better TPL is at acquiring more lucrative royalty income (i.e. more 1/8th and less 1/128th royalties) the more valuable the asset becomes.

I believe this is a good start but it has many shortcomings. Oil has been coming out of the ground on TPL’s land for decade after decade. How do we account for that and for what is yet to come out of the ground?

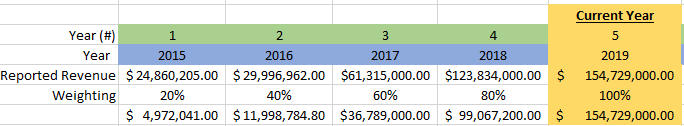

I propose an amortized asset value including the past 4 years, the current year and 5 years out of reported and yet to be reported oil and gas royalty revenue. The current year will be included at 100% while the year prior 80%, decreasing by 20% each year back. The weightings will decrease as the value that the oil asset created 4 years ago is less than the value that can be created today. Looking forward, we will include the next year also at 100% and the year following at 80%, decreasing by 20% each year forward. As the time table extends the certainty decreases and thus, the weighting does as well. For the last quarter of 2020 I used the Q4 data from 2019 since the 10Q/K is not available yet for Q4 2020.

(source: Author’s own calculations)

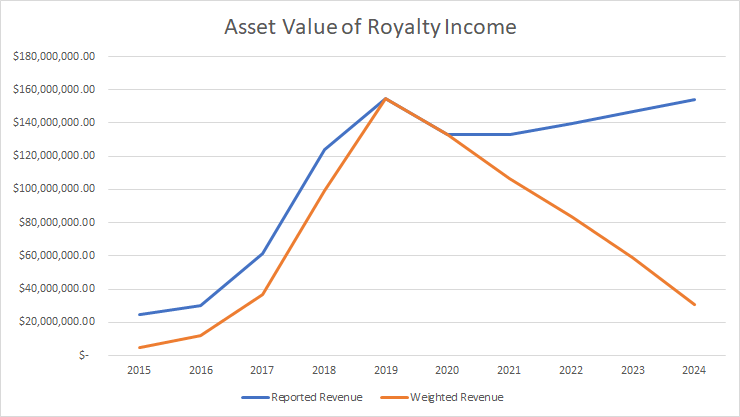

Here is a graphical interpretation of the above data:

(source: Author’s own calculations)

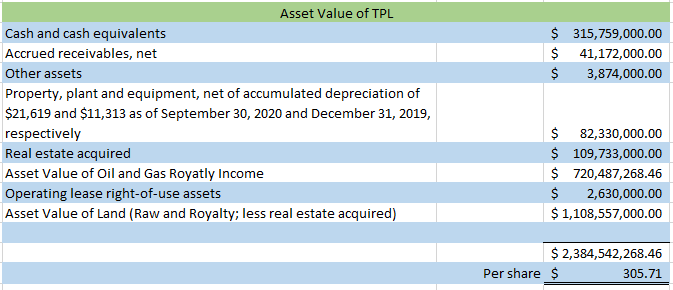

The asset value reported by the ongoing oil and gas royalty revenue will come to $720,487,268.46 or $92.37 Per share. I assumed a very conservative 5% growth rate for years 2021, 22, 23 and 24 which is much more conservative than it’s historical growth.

Value of Water Business Assets

As for the water business I am taking book value of the assets.

Reproduced Assets of TPL

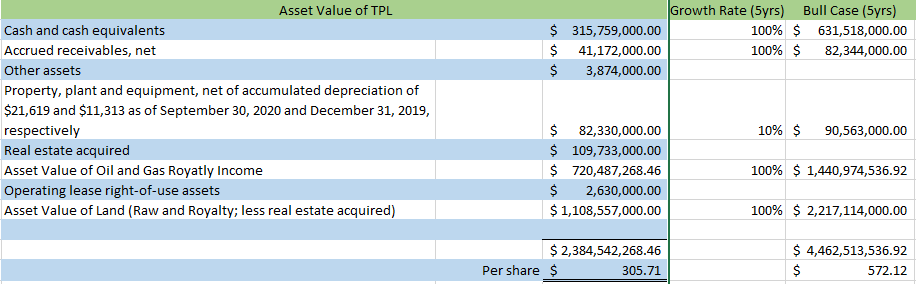

The main purpose of this study was to reproduce the assets of TPL, especially the “Real estate and royalty interests assigned through the 1888 Declaration of Trust, no value assigned:” line on the balance sheet and explore if growth adds values:

The Value of Asset Growth

Growth, in any enterprise is the hardest to value. Ironically, the most time in many analysis’s is spent on understanding if the company is growing and if it’s growth actually creates any value. TPL is different and opposite. You aren’t buying an operation (hopefully), or earnings, you are buying cash flowing assets. It’s assets are the hardest to value while the growth of TPL, in my opinion is plain, clear and creates immense value. The challenge of valuing the assets of TPL may become easier as time continues and the new corporate structure unveils much of the hidden and unknown info once shrouded by the Trust structure.

The Bear Case (Probability: 5%)

For the bear case to become a reality over the next five years the market would need to see:

an oil glut build up and maintain an over supply in the market.

A partnering deflationary environment.

no growth in global oil demand even from developing countries.

Oil price would most likely decrease in this environment.

The Bull Case (Probability: 65%)

The current over supply of oil continues to shrink through the end of 2021.

Inflation starts to pick up in the next year or so.

Oil prices really start to gain tail-wind over the next year and into the future.

One nice thing that would be nice to see is share buy backs starting back up! But I will save this for the Super Bull Case.

The Super Bull Case (Probability: 30%)

Share buybacks start back up at the rate they existed at before.

The market starts to see oil scarcity and liquids/gas pipeline capacity issues as production returns back to normal or increases slightly. This problem is of course aided by recent policy and worry about oil drilling on federal land and the headwinds for the Keystone pipeline.

Many of the DUCs reported in TPL’s 10K/Qs will start to produce.

The water business continues to improve its efficiencies.

Lastly, in this example like above, we see oil prices appreciate through 2021 into the future.

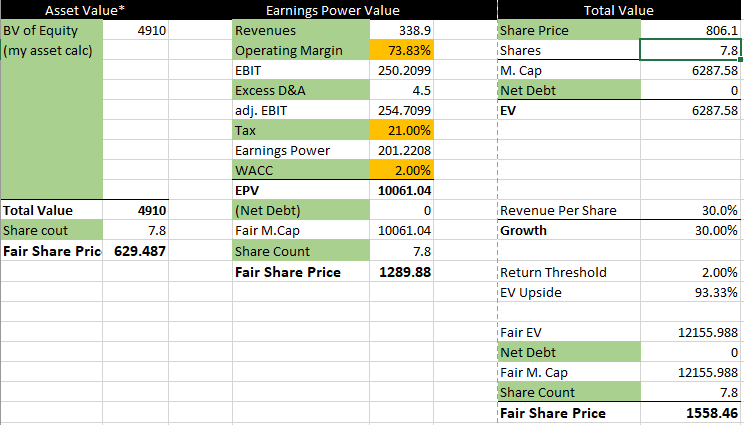

Putting It All Together

Weighting each asset value according to the assigned probability gets us fair asset value of $4,910,272,353.11 or $629.48 per share in 5 years representing a 105% upside from todays asset value found above. I used the earnings power value method of valuation mainly because it highlights the asset value well, the growth I am assuming is easy to see (and historically conservative!) and because its shows the operating efficiencies of TPL and the value it creates. In my estimates, there is about another 93% of upside in TPL before we can say the stock has reached it’s intrinsic value, or Total Value.

Be sure to share and leave a comment! TPL is a challenge to value and I know that opinion is shared amongst many TPL investors. I look forward to the hearty conversations to follow. As fundamentals change going forward, so do valuations.

***While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment.***