The Permian Basin In a New Corporation: Part 1

How a bankrupt railroad became the purest oil play in America.

Before (or after) reading if you found this article interesting or fun to read please do not hesitate in subscribing and sharing!

My goal is to explain a brief history of railroads and oil in the Permian Basin oil field in west Texas and highlight, what is in my opinion the best and purest oil investment in America.

The History of the Trust

The Investment

The Business Model of the Trust

Grievances

The History of the Trust

The Texas and Pacific Railway was a federally chartered railroad that came onto the scene shortly after the civil war and was chartered to build a rail road from Marshall, Texas to San Diego, California. The railway never reached San Diego and in 1888 during the wake of its Bankruptcy’s (the booms and busts of railroads in America and Europe is a story for another day) and as a way for the railroad to sell its massive land holdings The Texas Pacific Land Trust (TPL) was birthed. The Trust received over 3.5 million acres of flat, arid, west Texas wasteland. For comparison, the state of Rhode island is only 776,960 acres. I cant imagine how dry and boring that train ride must have been! Interestingly enough, there was a song written about the railway under the DECCA record label called, “Texas and Pacific” on the A side of the record describing the artists ride on the railway, while the B side contained a song called, “I Like 'Em Fat Like That." It would only be appropriate that it be called, “I Like ‘Em F(l)at Like That” since West Texas is the definition of what flat is (it is even flatter than the earth for you flat earthers out their!)

To put that amount of land into perspective, TPL until the end of 2006, even after selling over 2/3rds of it’s land was still the largest private land owner in the state of Texas and to this day is amongst the largest still. How did a railroad amass so much land in the first place?

"the company was granted a federal land grant of twenty sections of land per mile through California and forty sections through what is now Arizona and New Mexico and a state land grant of twenty sections in Texas" (source)

TPL could have been entitled to over 12 Million acres of land into what is now New Mexico, Arizona and even California all in addition to Texas, but because of the length of time it took to complete, the federal government decided to ultimately only grant a little over 5 million acres, 3.5 of which ultimately made it to the trust for the benefit of bond holders in The Texas and Pacific Railroad.

The Investment

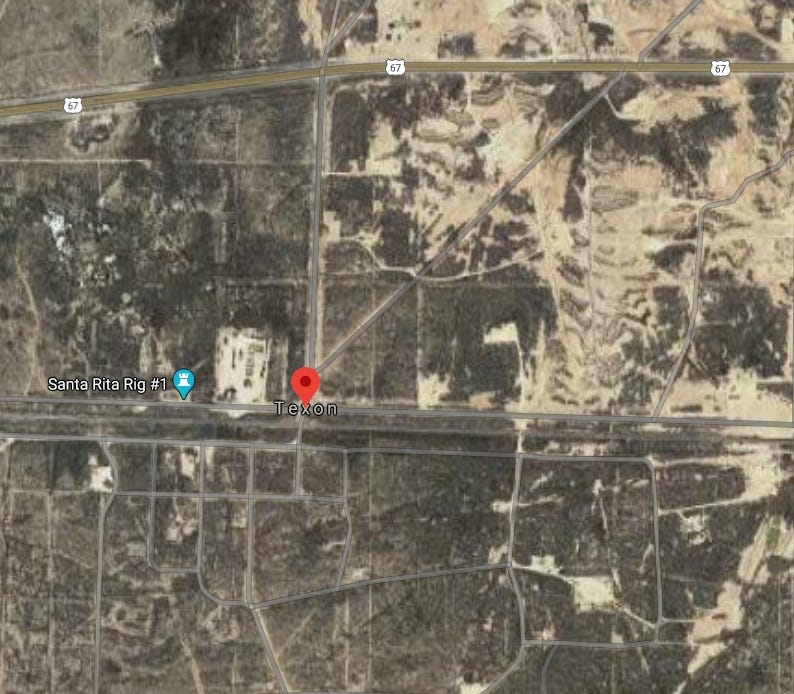

Ok, enough about trains and railroads. How does this become an investment idea article? The formation of the trust took place right around the same time oil was starting to become relevant in Texas, but it wasn’t until the early to mid 1920’s that oil became prevalent in the West Texas Permian Basin. Before the famous Santa Rita #1 well, located some equal distance southeast of Midland and Odessa, Texas in an unincorporated “town” called Texon, the Permian Basin was considered a complete oil graveyard.

Any geologist that thought differently was few and far in-between and considered crazy. After Santa Rita #1 was drilled and became commercially viable in 1923 producing 100-150 barrels of oil per day along with large quantities of water, it wasn’t long for the rest of West Texas to start to be explored. Much of it’s commercial success was driven by its nearness to a railroad. You might notice on TPL’s website that Santa Rita #1 was not the first well to be drilled in the Permian Basin, that honor goes to, “Texas and Pacific Abrams #1 in Mitchell County. [Texas and Pacific Abrams #1] became the first well to produce oil from the Permian Basin, and a few years later, the first oil pipeline was built in the basin.” (source).

Many don’s see the Abrams well as important though because it’s commercial viability has historically been questioned while the Santa Rita #1 well was a success. A bit of irony shows though that the Santa Rita #1 well from 1923 was plugged in 1990 after 67 years of service and the Abrams #1 well was still producing at least until 1995 giving some evidence that the well became economical to keep open. (source1, source2)

The important thing to draw from this point and going forward is that from the early 1920’s on, oil in the Permian Basin was here to stay, about to grow exponentially AND that there was 3.5 million acres of private, trust held land ready to profit. Separate from COVID-19, the Permian Basin oil production would still be growing today.

TPL was and is one of the best examples of, “at the right place at the right time.” Land once thought of as useless and void of life, water and oil will (and now has) become some of the most valuable land in undeveloped America and by far the most important oil field. In 1927, TPL listed it’s sub-certificates on the NYSE for trading making it not one of the oldest “companies” in America, but one of the oldest listed securities. Until January 12th, 2021 if you were to invest in TPL you would not be buying stock in a company, but sub-certificates of trust certificates. Confusing? yes.

The Business Model of the Trust

Harkening back to 1859, the infamous Drake Well in Pennsylvania leased land from the land owner. The payment was a 1/8 salt royalty since salt was also mined from the land that was leased. (source) TPL works much the same way. It owns the land, big oil drilling companies want the easier to get oil from their land, TPL gets a royalty for every drop of oil that comes out of their ground. Much of how royalties worked and work in the mining, minerals and water industries was applied to the first oil royalties and still exists as the heartbeat of the TPL business model today. If you do any research on any major stock research platform on TPL you will find a description like the following:

“Texas Pacific Land Trust is mainly engaged in sales and leases of land owned, retaining oil and gas royalties and the overall management of the land owned. The company operates its business in two segments including Land and Resource Management and Water Service and Operations. Texas Pacific owns approximately 900,000 acres of land located in various countries. The trust derives revenue from all avenues of managing the land which includes oil and gas royalties, grazing leases, easements, easements, and commercial leases, and land and material sales.” (source)

While this statement is true, the oil royalties are what make TPL live or die. The above statement, in my opinion, underplays the importance of oil royalties in the TPL business model. Without oil coming out of the ground and TPL getting paid, they wont have much land value to potentially sell, they wouldn’t have the need to offer water management resources to the wells on their land. In short, the operations they do have would most likely cease without the oil royalty. This is one of the reasons TPL is a pure oil play. The pureness is confirmed even on the companies homepage:

To some this seems dangerous, all the eggs are kind of in one basket for TPL.

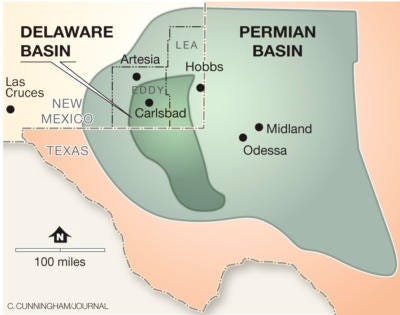

To me though, and many other TPL investors, an idiot could run TPL and not completely mess it up. To many, recent management is at minimum very (very, very, very) questionable and the trust has stayed resilient. One of the main reasons of this is that even within the Permian Basin, TPL’s land sits on the Delaware Basin, part of the large Permian Basin:

The assest really speaks and manages it self. The trust just sinply needs good managers and stewards, not operatoes. Below, is a picture from TPL’s website about where their acreage sits:

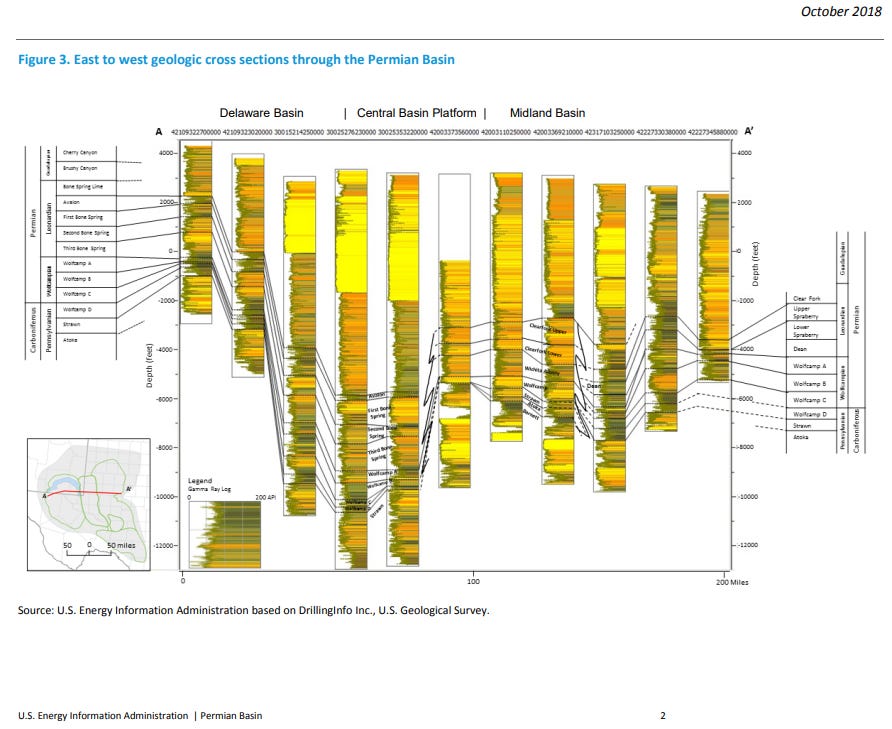

Briefly, the Delaware Basin boasts the shallowest oil in the entire Permian Basin:

Companies that drill on TPL’s land are more profitable on average than other areas of the basin, which is already a profitable place to explore for oil. I have seen oil price figures that range from $20/bbl to $40/bbl for profitability.

Much ink has been spilled about the royalty model and it’s efficiencies. The efficiencies of a royalty model are magnified in TPL. Before the water resource management, TPL had little to no operations and was the epitome of cash cows (and still is). TPL could have been run by (and maybe was in times past) a dude with his legs crossed on his desk depositing royalty checks. Of course I am simplifying the story a bit, but not by much. Understanding the margin’s of TPL will help clear up my point:

80-100% operating margins are not an anomaly for TPL and are the norm even with more operations within the trust than ever before in it’s history. To further this point the revenue of TPL has grown significantly without any need for leverage or sacrificing it’s operational efficiencies:

There is a significant challenge when writing about TPL. I have been following the position for a couple of years on seekingalpha, the tpltblog.com, Murray Stahl and other various sources. A glaring issue that has been a savior for some and a thorn in the side for many is the structure of TPL. One of the oddities the trusts investors had to grapple with is the fact that the trust itself is not an actual business, and it is not a corporation and thus has anything but a typical corporate structure. Again, the trust was not an actual business in and of it self, it is a trust. What is the big deal? Transparency. I doubt this is as big of an issue if the shareholders are happy with the trustees in place, but that story changed quick I assume around the time share buy backs stopped in 2018.

Grievances

I do not want to attempt to rehash the history of the issues that investors have had with TPL because it has been done in real time here: tpltblog.com and better than I could ever do it. As a side note, I think we have the sad tendency nowadays to rewrite books or articles that explained something very well and clearly in the past for the sake of writing alone today. To provide a summary though here were some of the grievances (source):

To provide some context TPL has gone through a conversion from a trust to a Delaware corporation. The pathway there was difficult, full of law suits and tumultuous to say the least. But the strength of the business model shined through. Without much operations, there was not much operators (trustees of the trust) could to to completely ruin the swan story that is TPL. Luckily the conversion was the biggest step in alleviating many of the concerns found above. Until January 12th, 2021 TPL had a governance structure only our great, great grandparents were vaguely familiar with. Today it is Delaware corporation.

Some of the thing on the list may surprise many investors that invest in regular, listed corporations. For example, #3, “Board members, including originating board members, must be voted upon by shareholders. Board terms should be of reasonable length.” Trustee’s were appointed for life and death or resignation/retirement seemed to be the only way a trustee was replaced. There is also no ownership requirements of the trustees. When it was time for a new trustee, the other existing trustees nominated a new trustee to be appointed for life. The power the trustee’s had to, get this, vote on their own salaries for a position they held for life began to rub many investors the wrong way.

Looking at one more example, #10, and this one will really shock ya! “Corporation must hold an annual meetings and be regularly open to investor communication” That is right, a demand of shareholders was that the corporation hold *at least* annual meetings that are open to investor communication. An analyst at Cove Street Capital comments on this, “There are no annual shareholder meetings, and there have been only four shareholder meetings in the last 30 years. The annual report is a brisk 23 pages, plus another 23 more pages of financial statements.” (source)While investing in TPL helps you avoid CEO’s that comment mid quarter on sales or revenue to give the stock a boost before earnings, you also avoid getting to communicate with the management at almost any level.

What I have described above is only the surface of the history surrounding the Texas Pacific Land Trust and the now Texas Pacific Land Corporation. I wanted to focus on the history of it’s location in the Permian Basin because I believe if you don’t understand the history of oil in that region and its prominence today an investor may underplay the significance and uniqueness TPL has in that region. In another article I will elaborate on:

The impact of COVID-19 and the global outlook for oil

Political Concerns

Inflation concerns and how that will affect TPL along with other hard assets

It’s history of value creation

I look forward to the comments and getting to chat with the community of investors that surround the Texas Pacific Land Corporation. Stay tuned, hopefully in one weeks time for the second part of this analysis!

If you like what you have read thus far, consider sharing with a friend and subscribing!

I love comments and discussion, so do not forget to leave a comment!